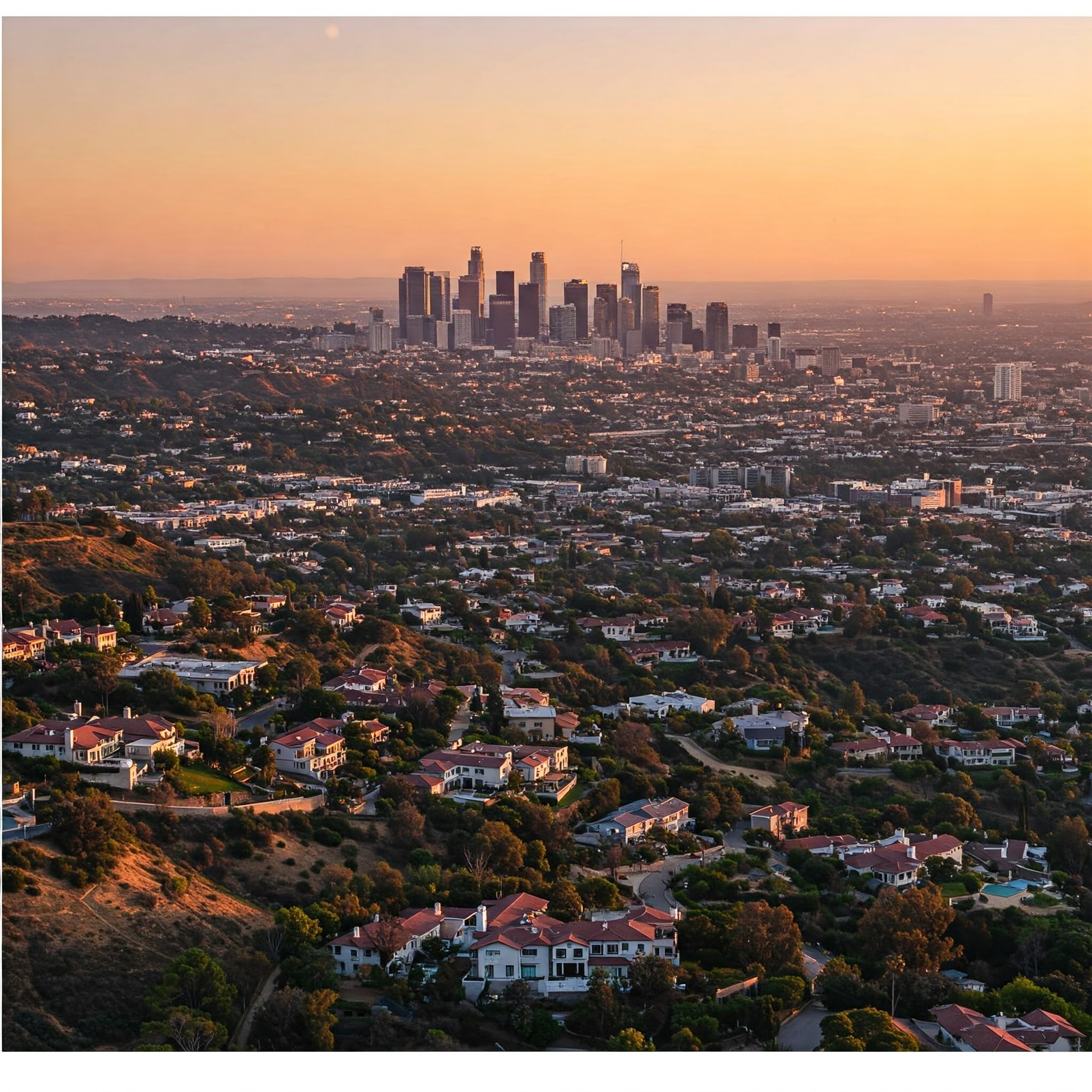

Homeowners Insurance in Los Angeles: Protecting Your Sanctuary

Your home in Los Angeles is more than just a place to live; it’s a significant investment, a place where memories are made, and a reflection of your life. Protecting this valuable asset is paramount. Homeowners insurance is designed to provide comprehensive financial protection for your home, belongings, and liability risks, offering peace of mind in the face of unexpected events.

Why Do You Need Homeowners Insurance in Los Angeles?

Los Angeles, with its unique blend of urban living and natural surroundings, presents specific challenges for homeowners:

- Diverse Risks: From earthquakes and wildfires to theft and water damage, Los Angeles homeowners face a variety of potential risks.

- High Property Values: The high cost of real estate in Los Angeles makes adequate insurance coverage even more critical. Ensuring your policy covers the full replacement cost of your home is essential.

- Liability Protection: Accidents can happen, and you could be held liable for injuries or damages on your property. Homeowners insurance provides crucial liability coverage.

What Does Homeowners Insurance Cover?

A standard homeowners insurance policy in Los Angeles typically covers:

- Dwelling Protection: This covers the physical structure of your home, including the foundation, walls, roof, and attached structures like garages and decks.

- Personal Property: This protects your belongings inside your home, such as furniture, electronics, clothing, and appliances, from covered perils.

- Other Structures: This covers detached structures on your property, like sheds, fences, and guest houses.

- Liability Protection: This protects you if you’re held responsible for injuries or damages to others, whether on your property or elsewhere.

- Additional Living Expenses: If your home becomes uninhabitable due to a covered peril, this coverage helps pay for temporary housing, meals, and other related expenses while your home is being repaired or rebuilt.

What Homeowners Insurance Doesn’t Cover:

It’s important to understand what standard homeowners insurance typically doesn’t cover:

- Earthquake Damage: Earthquake insurance is a separate policy in California due to the state’s seismic activity.

- Flood Damage: Flood insurance is also a separate policy, as it’s not covered by standard homeowners insurance.

- Wear and Tear: Homeowners insurance is designed to cover sudden and accidental events, not gradual wear and tear.

- Certain Exclusions: Specific perils may be excluded from coverage, so it’s essential to review your policy carefully.

Benefits of Homeowners Insurance in Los Angeles:

- Financial Protection: It safeguards your largest investment – your home – from potentially devastating financial losses.

- Peace of Mind: Knowing you have coverage allows you to focus on other things, knowing you’re protected from the unexpected.

- Liability Coverage: It shields you from potentially significant financial consequences if you’re held liable for injuries or damages.

- Assistance During Displacement: It helps you manage expenses and maintain your lifestyle if you’re displaced from your home due to a covered event.

Tips for Choosing Homeowners Insurance in Los Angeles:

- Assess Your Needs: Determine the appropriate coverage amounts for your dwelling, personal property, and liability protection.

- Compare Quotes: Shop around and compare quotes from multiple insurance companies to find the best rates and coverage options.

- Ask About Discounts: Many insurers offer discounts for things like security systems, bundled policies, and new homes.

- Read the Policy Carefully: Understand what’s covered and what’s excluded before you purchase a policy.

- Consider Additional Coverage: Evaluate your need for separate earthquake and flood insurance policies, as well as any other specialized coverage you may require.

Protecting Your Home in Los Angeles:

Homeowners insurance is a crucial investment for anyone owning a home in Los Angeles. It provides essential protection for your property, belongings, and liability risks. Don’t leave your home vulnerable. Contact us today to get a quote and learn more about how homeowners insurance can protect your sanctuary.