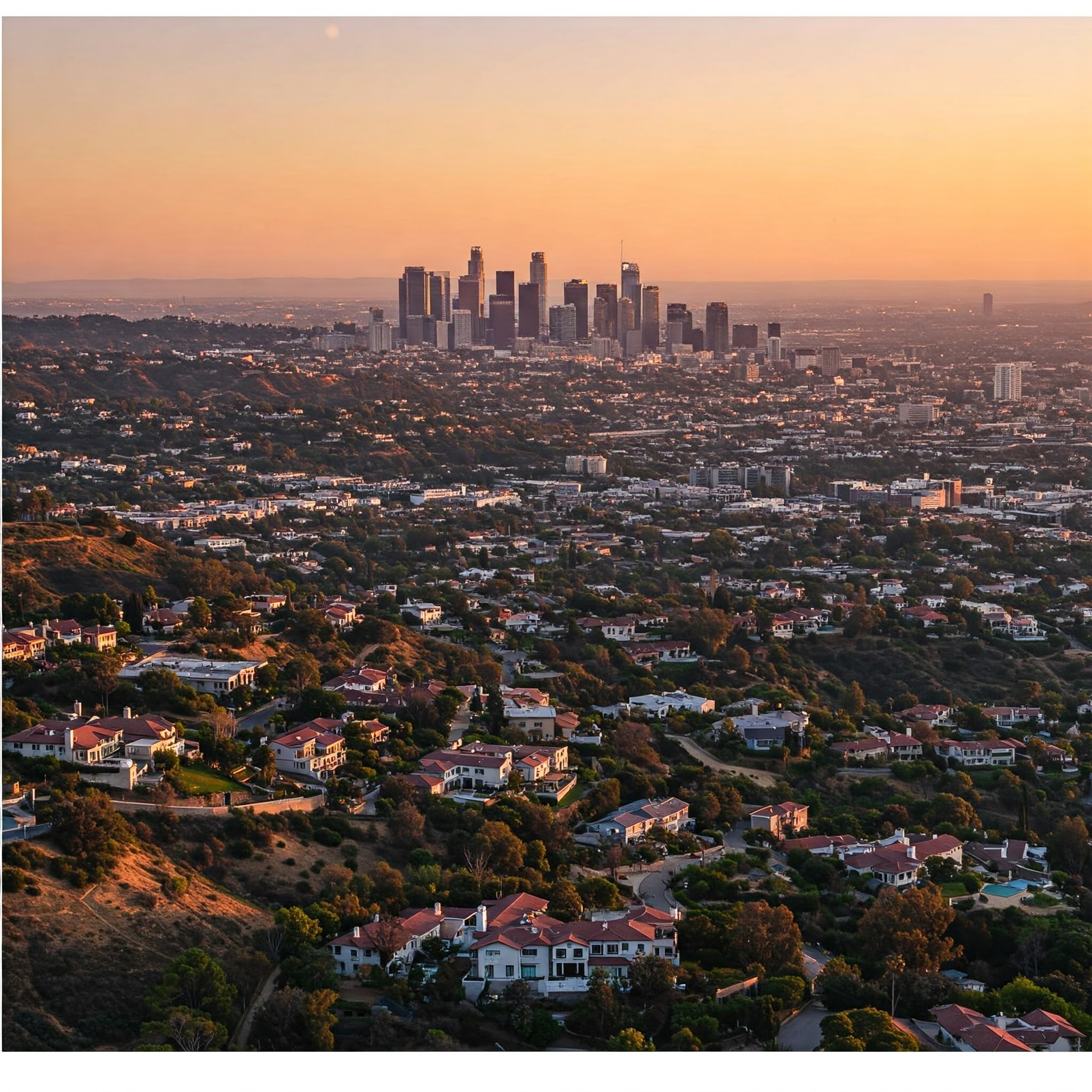

Expert Guidance: Navigating the Los Angeles Insurance Maze

The Los Angeles insurance market is a complex landscape, filled with diverse risks, specialized coverage options, and ever-changing regulations. Navigating this maze alone can be overwhelming, leaving you vulnerable to gaps in coverage or overpaying for unnecessary policies. That’s where expert guidance becomes invaluable. Working with a knowledgeable and experienced insurance professional can make all the difference in securing the right protection for your specific needs and budget.

Why is Expert Guidance Essential in Los Angeles?

Several factors make expert guidance crucial in the Los Angeles insurance market:

- Diverse Risks: From earthquakes and wildfires to floods and urban-specific challenges, Los Angeles presents a wide array of potential risks. Understanding these risks and how they apply to your specific situation requires expert analysis.

- Specialized Coverage: The need for specialized coverage, such as earthquake, flood, or wildfire insurance, adds complexity to the insurance process. Expert guidance can help you determine which specialized policies are necessary and navigate the options available.

- Complex Regulations: California’s insurance regulations can be intricate. Working with an expert ensures your policies comply with all applicable laws and requirements.

- Market Fluctuations: The insurance market is constantly changing, with premiums and coverage options influenced by various factors. An expert can keep you informed of these changes and help you adapt your policies accordingly.

- Finding the Best Value: Comparing policies from multiple insurers can be time-consuming and confusing. An expert can streamline this process, helping you find the best coverage at the most competitive price.

How Expert Guidance Benefits You:

- Personalized Risk Assessment: A qualified insurance professional will take the time to understand your unique circumstances, assess your specific risks, and recommend tailored solutions.

- Comprehensive Coverage: Expert guidance ensures you have the right combination of policies to protect all your assets, leaving no gaps in coverage.

- Cost Savings: An expert can help you identify unnecessary coverage and find discounts you may be eligible for, ultimately saving you money.

- Simplified Process: Navigating the insurance process can be complex and time-consuming. An expert can handle the paperwork, negotiate with insurers, and make the process smoother and less stressful.

- Claims Assistance: In the event of a claim, an expert can advocate for you, helping you navigate the claims process and receive fair compensation.

- Ongoing Support: An insurance professional provides ongoing support, answering your questions, reviewing your policies, and keeping you informed of any changes in the market or regulations.

What to Look for in an Insurance Professional:

- Experience: Choose an insurance professional with a proven track record and extensive experience in the Los Angeles market.

- Knowledge: Ensure they have a deep understanding of the local risks, regulations, and available coverage options.

- Reputation: Check online reviews and ask for referrals to find a reputable and trustworthy professional.

- Personalized Approach: Look for someone who takes the time to understand your individual needs and provides personalized advice.

- Communication: Choose an insurance professional who communicates clearly and effectively, explaining complex insurance concepts in a way you can understand.

Securing the right insurance coverage is a critical decision. Don’t leave it to chance. Partner with an experienced insurance professional who can provide the expert guidance you need to navigate the Los Angeles insurance market with confidence. Contact us today for a consultation and let us help you protect what matters most.