Navigating Auto Insurance in Los Angeles: Your Guide to Coverage and Savings

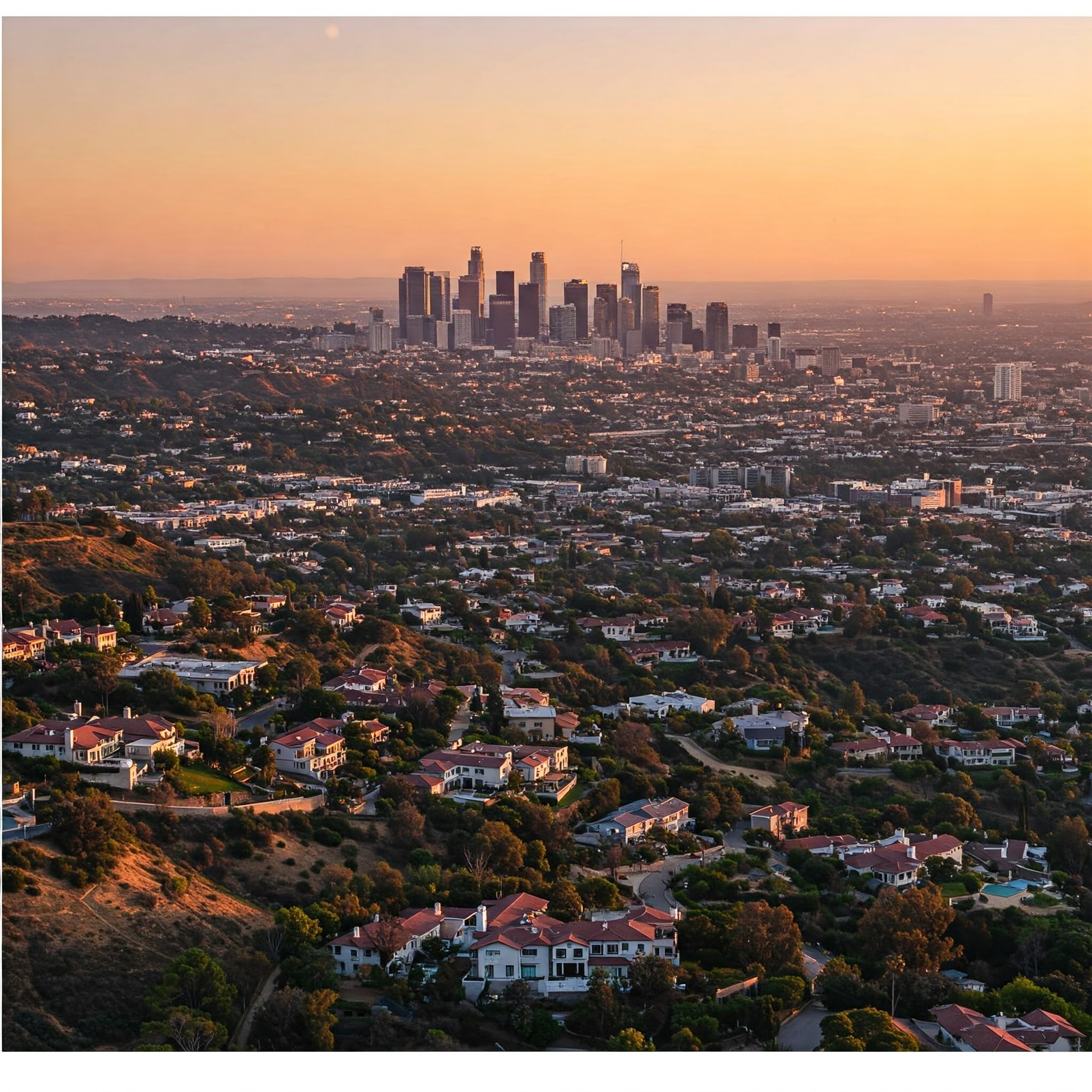

Los Angeles, a city of freeways, traffic, and diverse driving conditions, demands careful consideration when it comes to auto insurance. Whether you’re commuting across town or cruising along the Pacific Coast Highway, having the right auto insurance coverage is crucial for protecting yourself financially in case of an accident. This guide will help you understand the essentials of auto insurance in Los Angeles, from required coverage to finding the best rates.

Understanding California’s Auto Insurance Requirements:

California law mandates that all drivers carry minimum levels of liability insurance. These minimums are:

- Bodily Injury Liability: $15,000 per person / $30,000 per accident

- Property Damage Liability: $5,000 per accident

While these minimums are legally required, they may not provide enough coverage in the event of a serious accident. Consider increasing your liability limits to protect your assets from potential lawsuits.

Beyond the Basics: Exploring Additional Coverage Options:

In addition to liability coverage, several other options can enhance your protection:

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re hit by a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. Given the number of uninsured drivers in some areas, this is highly recommended.

- Collision Coverage: This covers damage to your own vehicle, regardless of who is at fault in an accident.

- Comprehensive Coverage: This protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, or natural disasters.

- Medical Payments Coverage: This helps pay for medical expenses for you and your passengers, regardless of fault.

- Rental Reimbursement: This helps cover the cost of a rental car while your vehicle is being repaired after a covered accident.

Factors Affecting Auto Insurance Rates in Los Angeles:

Several factors can influence your auto insurance premiums in Los Angeles:

- Driving History: A clean driving record with no accidents or traffic violations will generally result in lower rates.

- Vehicle Type: The make and model of your vehicle, its age, and its safety features can all affect your premiums.

- Location: Where you live in Los Angeles can play a role, as some areas have higher rates of accidents or theft.

- Age and Experience: Younger drivers and those with less driving experience may pay higher rates.

- Credit Score: In California, insurers can use your credit score to help determine your premiums.

- Coverage Limits: Choosing higher coverage limits will generally increase your premiums.

Tips for Finding Affordable Auto Insurance in Los Angeles:

- Shop Around: Compare quotes from multiple insurance companies to find the best rates.

- Bundle Policies: Combining your auto insurance with other policies, such as homeowners or renters insurance, can often result in discounts.

- Maintain a Good Driving Record: Avoid accidents and traffic violations to keep your premiums low.

- Take Advantage of Discounts: Many insurers offer discounts for things like good grades, safety features in your vehicle, and completing defensive driving courses.

- Consider a Higher Deductible: Choosing a higher deductible can lower your premiums, but make sure you can afford to pay it if you need to file a claim.

- Review Your Coverage Regularly: As your needs change, review your coverage to ensure it’s still adequate and that you’re not paying for unnecessary options.

Navigating the Los Angeles Roads:

Driving in Los Angeles can be challenging, with heavy traffic, complex freeway systems, and a diverse range of driving styles. Staying safe on the road requires:

- Defensive Driving: Be aware of your surroundings, anticipate potential hazards, and drive defensively.

- Avoiding Distractions: Put away your phone and avoid other distractions while driving.

- Following Traffic Laws: Obey speed limits, traffic signals, and other traffic laws.

- Driving Sober: Never drive under the influence of alcohol or drugs.

Protecting Yourself on the Road:

Auto insurance is not just a legal requirement; it’s a crucial financial safeguard. Having the right coverage can protect you from significant financial losses in the event of an accident. We can help you navigate the complexities of auto insurance in Los Angeles and find the best coverage at a competitive price. Contact us today for a personalized consultation.