The right policy for LA residents

Specializing in the LA market

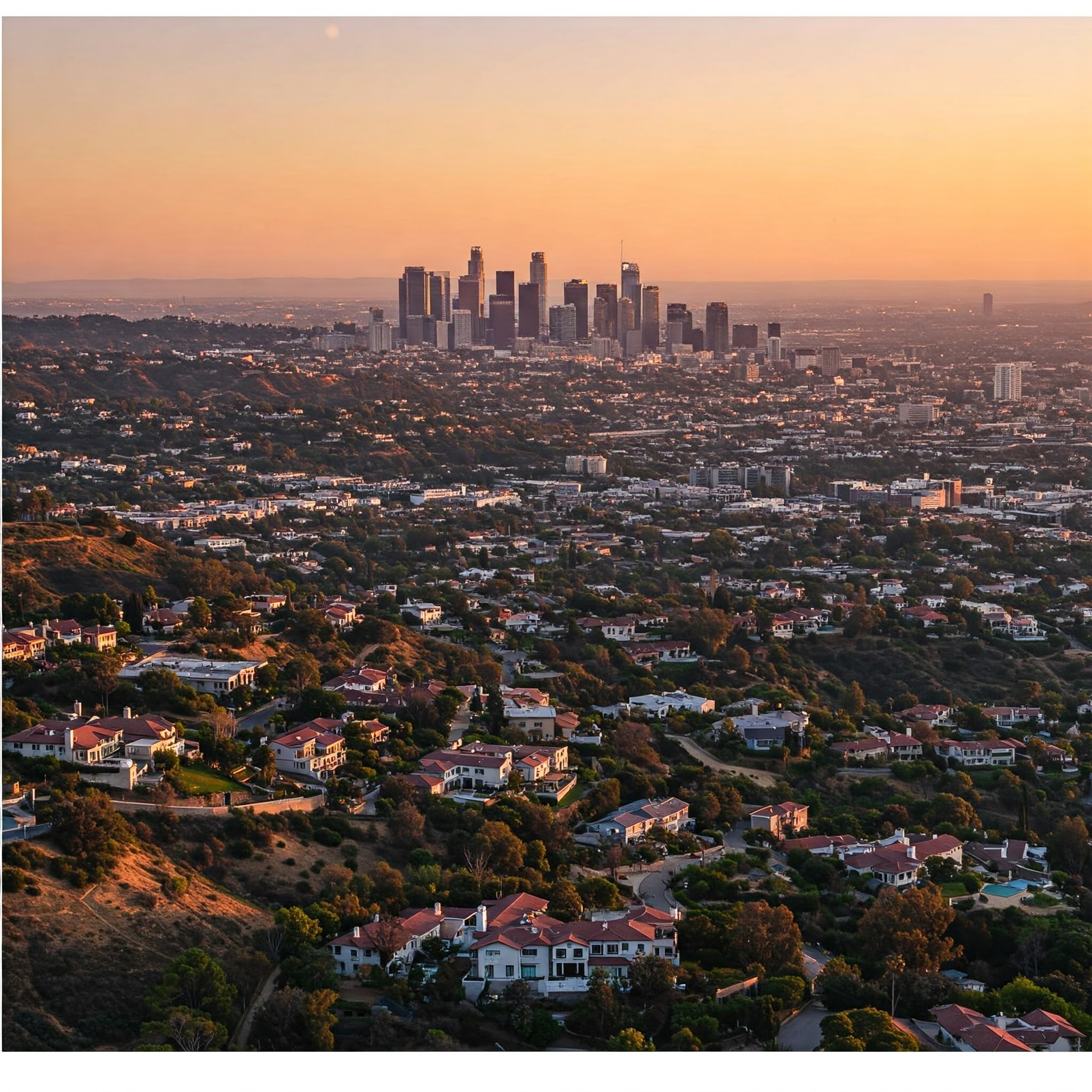

Choosing a local insurance provider means choosing someone who understands the unique challenges of Los Angeles living. From the heat of the Valley to the coastal breezes, and from everyday risks to the potential for earthquakes, your home faces specific vulnerabilities. Local agents work with you to create a custom plan that addresses these needs, offering protection against weather damage, natural disasters, and property theft – a significant concern in our city. We understand the risks and are here to help you secure the right coverage for your peace of mind.

Product Highlights:

Comprehensive coverage, competitive rates, personalized service, and peace of mind

Why Choose Us:

Local expertise, personalized plans, comprehensive coverage, unbeatable value

Dwelling Protection

Safeguards your Los Angeles home – from foundation to roof – against covered perils like fire, storms, and even earthquake damage

Personal Property

Protects your belongings – furniture, electronics, clothes, and more – within your LA home, helping you replace or repair them after a covered loss.

Extended Replacement Cost

Provides extra financial cushion, up to 150%, to rebuild your home in today’s fluctuating LA construction market, should a covered loss occur.

Additional Living Expenses

Covers temporary housing and related costs if you’re displaced from your LA home due to a covered incident, keeping you comfortable while you rebuild.

Personal Liability Protection

Shields you from financial loss if you’re held responsible for injuries or damages to others, whether on your property or elsewhere in Los Angeles.

Guest Medical Protection

Helps with medical expenses if a guest is accidentally injured on your Los Angeles property, offering a caring touch in a difficult situation.

Los Angeles Homeowners Insurance

We believe every Los Angeles homeowner deserves comprehensive protection. That’s why we offer a variety of homeowners insurance options. Our local agents throughout the LA area are dedicated to finding the right policy to meet your specific needs and protect your best interests.

Protect your investment with the right insurance

How Much Is Average Homeowner Insurance in Los Angeles?

Homeowners insurance costs vary significantly based on many factors, including location, the age and construction of your home, coverage levels, and more. 1 While statewide averages can offer a general idea, your specific needs and property in Los Angeles will determine your actual premium. Contact us today for a free, personalized quote to see how we can help you find affordable and comprehensive coverage.

What Does 100% Replacement Cost Mean?

We recommend insuring your Los Angeles home for its full replacement cost to ensure complete coverage after a covered loss. 1 Replacement cost is the estimated expense to rebuild your home excluding the value of the land. 2 This differs from market value, which reflects what a buyer would pay for your home including the land. Insuring for 100% replacement cost helps you rebuild without unexpected out-of-pocket expenses for covered damages.

Does Los Angeles Home Insurance Cover Water and Flood Damage?

Standard homeowners insurance policies in Los Angeles typically cover water damage resulting from sudden and accidental events within your home, like burst pipes or appliance malfunctions. However, it’s crucial to understand that flood damage is not covered by standard homeowners insurance. Given the potential for flooding in certain areas, you’ll need a separate flood insurance policy to protect your home from this specific risk.

Does Home Insurance Cover Everything in a Fire?

Homeowners insurance generally covers damage to your Los Angeles home and belongings caused by fire, whether accidental (like a kitchen fire) or natural (such as wildfires, a significant risk in some areas). However, specific coverage details and exclusions can vary, so it’s essential to review your policy.

Is Home Insurance Required in Los Angeles?

While California doesn’t mandate homeowners insurance, if you have a mortgage, your lender will likely require it. Even if you own your home outright, having insurance is highly recommended to protect your investment and financial well-being in the event of unforeseen circumstances.

What Insurance Options Are Available for Los Angeles Residents?

Los Angeles residents have a wide range of insurance options to consider, including:

- Homeowners Insurance: Essential protection for your property against fire, theft, water damage (excluding floods), and other covered perils. Condo and renters insurance are also available for those who don’t own a single-family home.

- Auto Insurance: Mandated by California law, auto insurance protects you financially in case of accidents, property damage, and injuries.

- Earthquake Insurance: Given the seismic activity in California, earthquake insurance is a critical consideration for Los Angeles homeowners. It’s typically a separate policy from standard homeowners insurance.

- Flood Insurance: As mentioned, flood insurance is separate from homeowners insurance and is recommended, especially for properties in flood-prone areas.

- Life Insurance: Provides financial security for your loved ones in the event of your passing.

- Health Insurance: Covers medical expenses and helps you access healthcare services.

- Umbrella Insurance: Provides an extra layer of liability protection beyond your other policies.

- Personal Property Insurance: Covers valuable items like jewelry, art, or collectibles that may have limited coverage under a standard homeowners policy.

It’s important to assess your individual needs and risks to determine the right combination of insurance coverage for your situation in Los Angeles. Consulting with an insurance professional can help you navigate these options and find the best policies for you.

The Unique Challenges of the Los Angeles Insurance Market

Los Angeles isn’t just a city; it’s a collection of diverse communities, each with its own set of characteristics and potential risks. This unique landscape makes navigating the insurance market particularly complex, demanding specialized knowledge and tailored solutions. Here’s why:

Key notes

There is no place like LA

Diverse Geography: From the coast to the mountains, Los Angeles encompasses a wide range of terrains and microclimates. Coastal areas face risks like erosion and flooding, while inland regions grapple with wildfires and extreme heat. This geographical diversity necessitates specific coverage considerations that a one-size-fits-all insurance approach simply can’t address.

Seismic Activity: Living in earthquake country means seismic risk is a constant concern. Standard homeowners insurance policies often exclude earthquake damage, requiring a separate earthquake insurance policy. Understanding the nuances of earthquake coverage and the specific risks in your area is crucial.

Urban Density: Los Angeles’s dense urban environment presents unique challenges, including increased risks of theft, vandalism, and liability claims. Understanding these specific urban risks and having appropriate coverage is essential.

Wildfire Risk: Many parts of Los Angeles, particularly those bordering canyons and brush-covered areas, are susceptible to wildfires. Navigating the complexities of wildfire insurance, including understanding fire risk scores and available coverage options, is vital for homeowners in these areas.

High Property Values: Real estate in Los Angeles commands high prices, making adequate coverage even more critical. Ensuring your policy covers the full replacement cost of your home and belongings is essential to avoid significant financial hardship in the event of a loss.

Specific Local Regulations: California and Los Angeles have specific insurance regulations that can be complex. Working with local experts who understand these regulations ensures your coverage complies with all requirements.

Because of these unique factors, generic insurance policies often fall short in Los Angeles. You need an insurance partner who understands the local market intricacies, can assess your specific risks, and tailor a policy that provides the comprehensive protection you need. That’s where our expertise comes in. We’re here to help you navigate the complexities of the Los Angeles insurance market and secure the peace of mind you deserve.